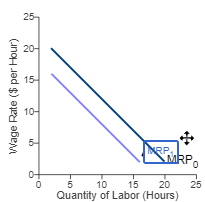

Consider a perfectly competitive? firm's marginal revenue product of labor curve shown in the diagram. Using the line drawing tool?, draw a new line that shows the effect of a decrease in the demand for the product produced by this firm. Label this line ?'MRP1?'. Carefully follow the instructions? above, and only draw the required objects.

For the perfectly competitive? firm, the marginal revenue product is

A.marginal physical product times the wage rate.

B.marginal physical product times the product price.

C.the same thing as marginal physical product.

D.the same thing as marginal factor cost.

B.marginal physical product times the product price.

You might also like to view...

The self-correcting property of the economy means that output gaps are eventually eliminated by:

A. increasing or decreasing potential output. B. government policy. C. decreasing inflation only. D. increasing or decreasing inflation.

To acquire financial capital, a firm can

i. obtain a loan from a bank. ii. issue stock. iii. issue bonds. A) i, ii, and iii B) i and iii C) i only D) iii only E) ii only

Suppose the required reserve ratio is 5 percent and the Fed buys a $10,000 bond. If money is deposited into a commercial bank, what will initially happen to money supply?

a. It will increase by $10,000. b. It will increase by $5,000. c. It will increase by 5 percent. d. It will increase by $200,000.

Assume that the current demand for goods DOES depend on expectations in the IS-LM model. A monetary expansion in the current period will cause a rightward shift in the IS curve if

A) current and expected future real interest rates are positively related. B) current and expected future real interest rates are negatively related. C) current and expected future real interest rates are unrelated. D) the central bank is expected to reverse any current movements in monetary policy in the future. E) monetary policy cannot affect, directly or indirectly, the position of the IS curve in the current period.