Wurst & Wurst is the accounting firm that has been used by the Intercontinental Bank for over twenty years. Tim approached Alfred, a Wurst partner, at a cocktail party. Tim asked about the bank's stability. Although Alfred knew that the bank's stock was

overvalued because of some questionable loans, he felt a considerable amount of loyalty to the bank for being a good customer of his accounting firm. Alfred told Tim that Wurst had just finished an audit of the bank, and that the bank was as sound as the Rock of Gibraltar. The next day Tim bought 1,000 shares of Intercontinental. One month later, the bank's losses became the subject of a major financial scandal. Tim is angry and wants to sue. Does he have a case?

Yes, under Rule 10b-5, an accountant may be held civilly liable for an oral misstatement as long as it is of a material fact. Tim relied on the statement made by Alfred. Alfred knew the statement was deceptive and had scienter, or knowledge of the deception. There is also a possibility that Alfred could have criminal liability for violation of Rule10b-5.

You might also like to view...

The United States

a. has used antidumping laws sparingly to protect domestic producers. b. has never used antidumping laws to protect domestic producers. c. has targeted antidumping action against Canada only so far. d. has been a heavy user of antidumping laws to protect domestic producers.

A process cost system be appropriate for a

a. catering business b. custom cabinet builder c. natural gas refinery d. jet airplane builder

Why do Internet users develop a screen name?

What will be an ideal response?

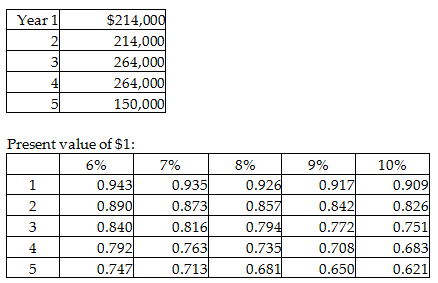

The company's annual required rate of return is 9%. Using the factors in the table, calculate the present value of the cash flows. (Round all calculations to the nearest whole dollar.)

Home Express Moving Company is considering purchasing new equipment that costs $728,000. Its management estimates that the equipment will generate cash inflows as follows:

A) $892,000

B) $864,646

C) $853,320

D) $894,000