Tax distortions happen because tax laws take into consideration only:

A. nominal income.

B. nominal output.

C. real income.

D. real output.

Answer: A

You might also like to view...

If a consumer places a value of $15 on a particular good and if the price of the good is $17, then the

a. consumer has consumer surplus of $2 if he or she buys the good. b. consumer does not purchase the good. c. market is not a competitive market. d. price of the good will fall due to market forces.

"New industries need to be protected or they won't have the opportunity to grow up." This is a statement of the __________ argument for trade restrictions

A) national-defense B) infant-industry C) anti-dumping D) tariff E) none of the above

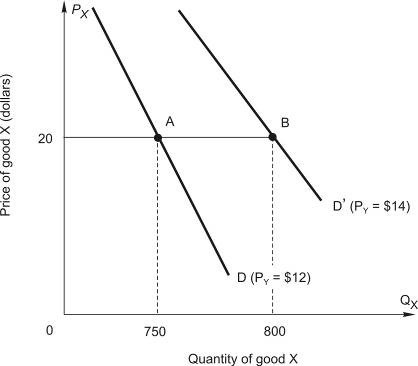

Use the figure below to calculate the cross-price elasticity of demand for good X when the price of good Y increases from $12 to $14:

A. 0.64 B. 0.20 C. 15.38 D. 0.42 E. 2.00

The Cournot model assumes that the firms take their competitors output as fixed.

Answer the following statement true (T) or false (F)