The federal income tax began in the United States with the

a. Morrill Act of 1862.

b. addition of the Bill of Rights to the Constitution in 1791.

c. passage of the 16th Amendment to the Constitution in 1913.

d. New Deal legislation of the 1930s.

c

You might also like to view...

The International Monetary Fund plays the key role of

A) providing deposit insurance for banks in its member nations. B) acting as lender of last resort for its member countries' central banks. C) providing loans to member countries to help finance development projects. D) enforcing international monetary agreements.

What is one of the most important advantages of a free market?

What will be an ideal response?

How would it affect the unemployment rate if the Bureau of Labor Statistics counted as unemployed both? (1) discouraged workers and? (2) people who work? part-time but would prefer to work? full-time?

What will be an ideal response?

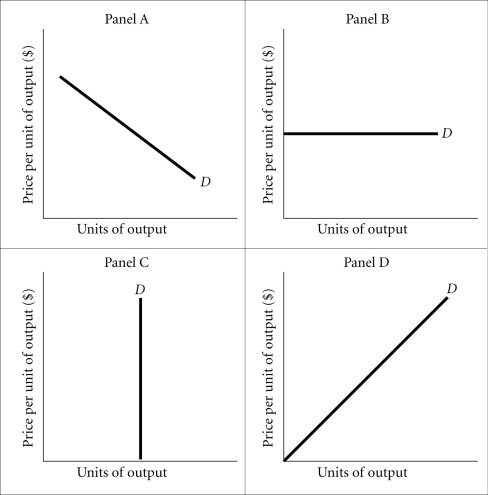

Refer to the information provided in Figure 13.1 below to answer the question that follows. Figure 13.1Refer to Figure 13.1. The demand curve facing an individual producer of wheat is most likely represented by

Figure 13.1Refer to Figure 13.1. The demand curve facing an individual producer of wheat is most likely represented by

A. Panel A. B. Panel B. C. Panel C. D. Panel D.