One of the primary aims of taxation is:

A. to increase government revenues.

B. to reduce the equilibrium quantity.

C. to alter the incentives of market participants.

D. All of these are primary goals of taxation.

D. All of these are primary goals of taxation.

You might also like to view...

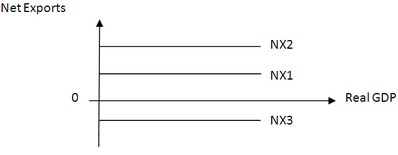

Use the following diagram to answer the next question. We observe that the economy has moved from NX1 to NX3. This could have happened because ________.

We observe that the economy has moved from NX1 to NX3. This could have happened because ________.

A. imports decreased B. exports increased by more than imports C. exports increased by less than imports D. exports increased

If real GDP was 100 in 2015 and 104.4 in 2016, the growth rate of real GDP between 2015 and 2016 was

A) 2.2 percent. B) 4.4 percent. C) 100 percent. D) 102.2 percent.

Using the table above, the working-age population is

A) 155 million. B) 170 million. C) 195 million. D) 250 million. E) 220 million.

The estimates of the magnitude of government spending increase needed to have ended the 2007-2009 recession in the United States vary, based on the actual size of the expenditure multiplier, and range from

A) $250 million to $1 billion. B) $50 billion to $250 billion. C) $400 billion to $2.5 trillion. D) $5 trillion to $15 trillion.