If a government chooses to finance a budget deficit by borrowing and the expected inflation rate does not change, this will cause the real interest rate to ________ and the nominal interest rate to ________

A) increase; increase

B) increase; decrease

C) decrease; increase

D) decrease; decrease

A

You might also like to view...

An increase in a firm's fixed cost will not change the firm's profit-maximizing output in the short run

Indicate whether the statement is true or false

In the mid 1980s, the massive current account deficits were related to massive U.S. government budget deficits

Indicate whether the statement is true or false

Investors often pay professional analysts to gather and monitor information on the creditworthiness of borrowers because

A) federal law requires it. B) most investors are risk neutral. C) the cost of acquiring information about a borrower's creditworthiness can be high. D) doing so increases the net-of-tax yield on most investments.

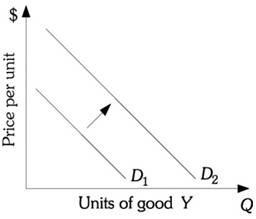

Refer to the information provided in Figure 5.5 below to answer the question that follows. Figure 5.5Refer to Figure 5.5. As the price of good W decreased, the demand for good Y shifted from D1 to D2. The cross-price elasticity of demand between W and Y is

Figure 5.5Refer to Figure 5.5. As the price of good W decreased, the demand for good Y shifted from D1 to D2. The cross-price elasticity of demand between W and Y is

A. zero. B. positive. C. negative. D. indeterminate from this information.