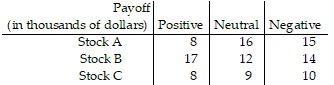

Solve the problem.A person is considering three different stocks, and each is sensitive to a certain economic indicator. The indicator will be positive, neutral, or negative, and fluctuate randomly. The payoffs are given in the table below, in thousands of dollars. What investment strategy should the person make to obtain the best expected value of profit?

A. Invest in Stock A with probability 1, invest in Stock B with probability 0, and invest in Stock C with probability 0.

B. Invest in Stock A with probability 5/13, invest in Stock B with probability 8/13, and invest in Stock C with probability 0.

C. Invest in Stock A with probability 4/13, invest in Stock B with probability 9/13, and invest in Stock C with probability 0.

D. Invest in Stock A with probability 0, invest in Stock B with probability 1, and invest in Stock C with probability 0.

Answer: B

You might also like to view...

What is the period when f = 60 Hz?

a. 6 msec b. 12.3 msec c. 16.7 msec d. 60.0 msec e. 117 msec

Decide whether or not the functions are inverses of each other.f(x) = 3x - 3, g(x) =  x + 1

x + 1

A. No B. Yes

Determine whether the given function is one-to-one. If it is one-to-one, find a formula for the inverse.f(x) =

A. f-1(x) = x3 + 1

B. f-1(x) = x3 - 1

C. Not one-to-one

D. f-1(x) =

Is the following correspondence a function?Domain: All students attending the University of OhioCorrespondence: Each student's teachersRange: A set of teachers

A. Yes B. No