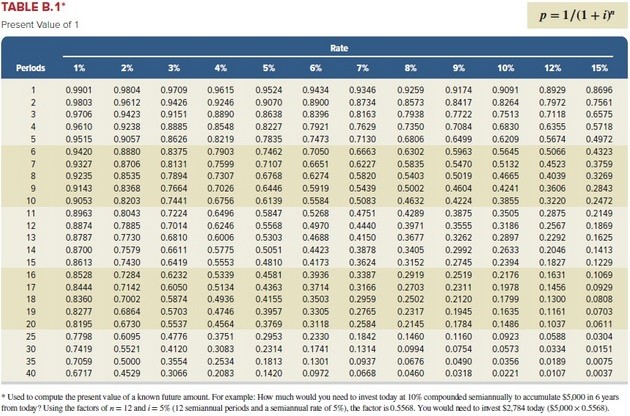

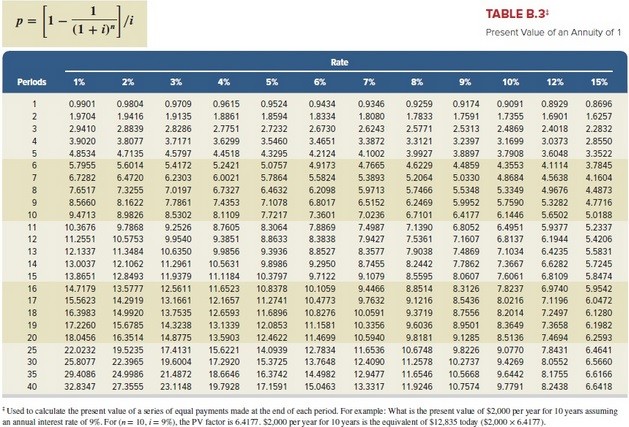

A company is considering an investment that will return $19,000 semiannually at the end of each semiannual period for 4 years. If the company requires an annual return of 10%, what is the maximum amount it is willing to pay for this investment? (PV of $1, FV

A company is considering an investment that will return $19,000 semiannually at the end of each semiannual period for 4 years. If the company requires an annual return of 10%, what is the maximum amount it is willing to pay for this investment? (PV of $1, FV

of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)

A. Not more than $122,801

B. Not more than $152,000

C. Not more than $60,228

D. Not more than $76,000

E. Not more than $120,456

Answer: A

You might also like to view...

Together with the cash flow statement, the income statement enables the investors to determine the rate of return the company is generating relative to the amount of capital invested

Indicate whether the statement is true or false

Cash flows to sales and cash flows to assets are measured in terms of

a. times. b. a percentage. c. dollars. d. days.

The employee’s name is an example of ______.

a. an entity b. an attribute c. an object d. a primary key

Suppose that the production manager procures an additional 10 labor hours. What impact will this have on the current optimal objective function value?

A) an increase of $50 B) an increase of $5 C) no change D) an increase of $35 E) a decrease of $165