In what way(s) can a pension plan be seen as the opposite of life insurance?

What will be an ideal response?

A pension plan pays off if you live; life insurance pays off if you don't. Both vehicles have some similarities; with a pension plan a saver makes regular payments (which may or may not be specified, depending on the type of pension plan) which are invested by the institution that oversees the plan. Upon retirement (or other specified circumstances) the person can draw funds out of the plan. With an insurance policy the insured makes regular payments of premiums (the amount of which are set by analysis of risk factors) and the policy would pay off only in the case of the insured's death. Indeed, with term insurance, the insured pays the premium and if he/she lives there is no payoff at all. That's why term insurance is usually cheaper than whole life insurance, particularly for younger people.

You might also like to view...

The Bretton Woods system

a. fixed exchange rates in terms of U.S. dollars b. fixed exchange rates in terms of all major currencies c. fixed exchange rates in terms of gold d. established a system of flexible exchange rates e. established the European monetary system

Automatic stabilizers in the economy tend to

A. overcompensate for the irregular swings in real GDP. B. dampen the irregular swings in real GDP. C. fully offset irregular swings in real GDP. D. magnify somewhat the irregular swings in real GDP.

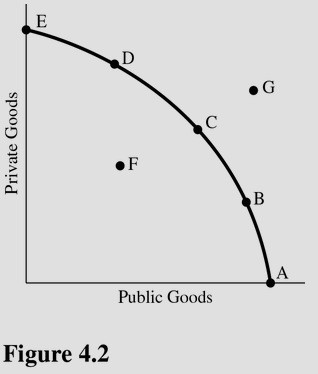

Using Figure 4.2, suppose point C represents the optimal mix of public and private goods for a society. The market mechanism is likely to result in a mix of output represented by point

Using Figure 4.2, suppose point C represents the optimal mix of public and private goods for a society. The market mechanism is likely to result in a mix of output represented by point

A. B because the market mechanism tends to overproduce public goods. B. F because the market mechanism is inefficient. C. D because the market mechanism tends to underproduce public goods. D. C because the market mechanism is efficient.

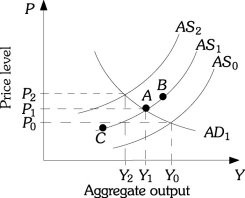

Refer to the information provided in Figure 27.3 below to answer the question(s) that follow. Figure 27.3Refer to Figure 27.3. Assume the economy is currently at Point A on aggregate supply curve AS1. A decrease in inflationary expectations that causes firms to decrease their prices

Figure 27.3Refer to Figure 27.3. Assume the economy is currently at Point A on aggregate supply curve AS1. A decrease in inflationary expectations that causes firms to decrease their prices

A. moves the economy to Point C on aggregate supply curve AS1. B. moves the economy to Point B on aggregate supply curve AS1. C. shifts the aggregate supply curve to AS0. D. shifts the aggregate supply curve to AS2.