Suppose that if your income is $100,000, your tax is $20,000, but if your income is $200,000, your tax is $45,000. Such a tax is

A. Proportional.

B. Regressive.

C. A flat tax.

D. Progressive.

Answer: D

You might also like to view...

Which of the following is a characteristic of a competitive market?

a. There are many barriers to entry. b. Firms sell differentiated products. c. Buyers and sellers are price takers. d. There are many buyers but few sellers.

The fact that the production function relating output to capital becomes flatter as we move from left to right means that

A) the marginal product of labor is positive. B) the marginal product of capital is positive. C) there is diminishing marginal productivity of labor. D) there is diminishing marginal productivity of capital.

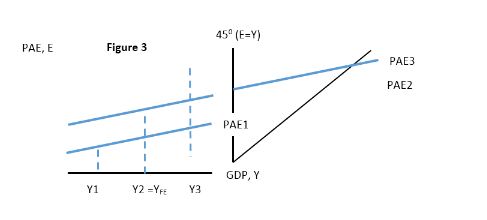

Using Figure 3 below the distance between what 2 lines illustrate a recessionary expenditure gap?

A. PAE2 to PAE3

B. PAE1 to PAE2

C. Y1 to Y2

D. Y2 to Y3

Which of the following is true of the per person income of the West (Western Europe and its offshoots of the United States, Canada, Australia, and New Zealand)

a. It has increased each century and grown steadily since 1500. b. It is now approximately 20 times greater than the figure of 200 years ago. c. It rose steadily between 1000 and 1800, but income growth has slowed during the past 200 years. d. While income per person has increased since 1800, there has been little change in life expectancy and other indicators of quality of life during this time period.