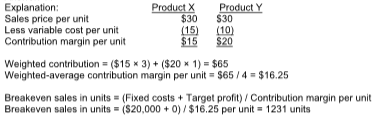

Asher Company sells two products—X and Y. Product X is sold for $30 per unit and has a variable cost per unit of $15. Product Y is sold for $30 per unit and has a variable cost of $10 per unit. Total fixed costs for the company are $20,000. Asher Company typically sells three units of Product X for every unit of Product Y. What is the breakeven point in total units? (Round any intermediate calculations to two decimal places, and your answer to the nearest unit.)

A) 1231 units

B) 923 units

C) 308 units

D) 1333 units

A) 1231 units

You might also like to view...

Many companies use MACRS (Modified Accelerated Cost Recovery System) depreciation for

a. financial reporting purposes and a different method for tax purposes. b. financial reporting purposes because depreciation is not allowed for tax purposes. c. tax purposes because it results in a larger net income in the early years of a plant asset's life d. tax purposes because of a desire to report higher expenses in early years in order to pay lower taxes.

The "Little Tucker Act" provides federal district courts concurrent jurisdiction in

certain cases with the Claims Court when the amount in controversy is under: a. $10,000 b. $15,000 c. $20,000 d. $25,000

You buy a blender costing $179.95. The store charges $25 for assembly and $25 for delivery. State taxes are 4.5% and local sales taxes are 2%. What is the total purchase price? (Round your answer to the nearest cent if necessary)

A) $192.88 B) $197.55 C) $241.65 D) $209.45

Which of the following would not represent a financing activity?

A. Borrowing money from a bank to purchase new equipment. B. Buying supplies. C. Paying dividends to stockholders. D. An investment of capital by the owners.