When and why should income taxes be considered in profit planning? What is the impact on target profit when income taxes are taken into account?

Income taxes should be considered in profit planning whenever a company is responsible for paying income taxes to the government. They should be considered in a decision-making process because the payment of income taxes will decrease the profits remaining in the business that may, in turn, be used to pay dividends to shareholders, pay off debt, and/or invest back into the business.

Target profit calculations will be different when income taxes are taken into account. Since income taxes are an additional expense, the company will have to sell an even higher number of units in order to earn a desired target profit than they otherwise would if income taxes were ignored or not a consideration.

You might also like to view...

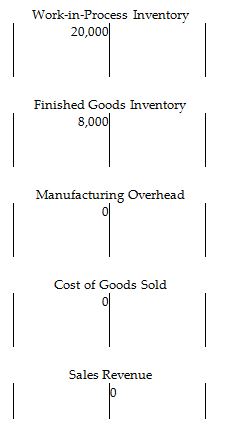

At the beginning of the year, Judge Manufacturing had the following account balances:

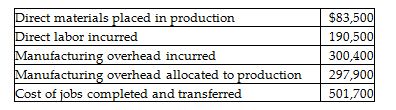

The following additional details are provided for the year:

The ending balance in the Finished Goods Inventory account is a ________.

A) debit of $509,700

B) debit of $501,700

C) debit of $8000

D) debit of $571,900

A capital expenditure is an expenditure that benefits only the current accounting period

Indicate whether the statement is true or false

COSO is one of the first efforts to address corporate culture in a quasi-regulatory framework in recognition of its significant impact on the satisfaction of organizational objectives.

Answer the following statement true (T) or false (F)

What steps can organizations take to encourage whistleblowers to speak up?

What will be an ideal response?