Explain the problem of adverse selection. How might this problem affect transactions in the insurance industry?

Please provide the best answer for the statement.

The adverse selection problem is an information problem that arises between buyer and seller. Buyers of a product who have the largest potential to benefit or to impose costs on a seller are also the ones most likely to enter into a contract with a seller, although the seller does not know this information ahead of time. In insurance purchases, for example, the people most likely to receive a payout from insurance are the very ones most likely to purchase insurance, but information about high-risk buyers is not known ahead of time by the seller. This adverse selection problem may result in losses that reduce the number of sellers in a private insurance market. Government intervention may be necessary to require social insurance so that a larger pool of people, rather than those most likely to benefit, purchase the insurance.

You might also like to view...

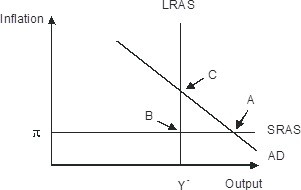

The economy pictured in the figure has a(n) ________ gap with a short-run equilibrium combination of inflation and output indicated by point ________.

A. recessionary; A B. recessionary; C C. recessionary; B D. expansionary; A

Which of the following is an example of a physical capital?

A) A factory B) A worker C) A stock D) A bond

If the price index in a country for the years 2012 and 2014 were 100 and 112, respectively, the inflation rate in 2014 was _____

a. 12 percent b. 20 percent c. 10 percent d. 5 percent

If the government spends less than what it receives in taxes during a given interval, then the result is

A. a government budget surplus. B. a balanced budget. C. an entitlement. D. unrealized public debt.