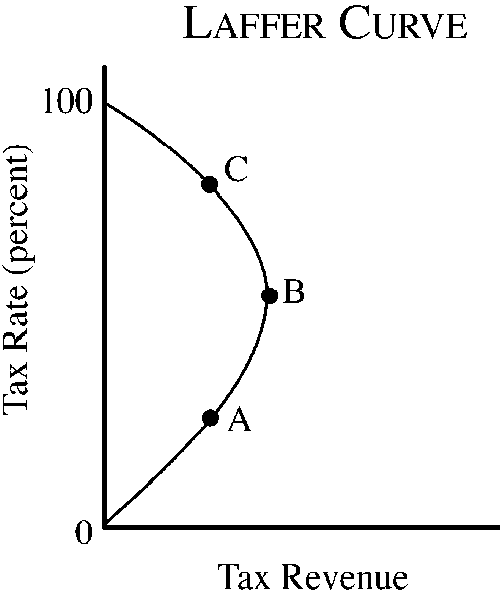

Figure 4-11

Refer to . On the Laffer curve shown, tax revenue could be increased by

a.

decreasing the marginal tax rates if we were currently at point A.

b.

decreasing the marginal tax rates if we were currently at point C.

c.

increasing the marginal tax rates if we were currently at point B.

d.

increasing the marginal tax rates if we were currently at point C.

b

You might also like to view...

The natural rate of interest is the interest rate that

A) is determined by the intersection of the IS and LM curves. B) equates investment and saving at full employment. C) equates the supply and demand for money. D) is changed only by changes in the money supply.

Veblen goods:

A. are an excellent example of the individual nature of utility. B. are goods which consumers buy to show how wealthy they are. C. are goods that people buy more of when their income decreases. D. are inferior goods.

In a perfectly competitive market, the equilibrium price

a. is determined by all the buyers in the market but no single buyer is able to influence it b. is determined by all the sellers in the market but no single seller is able to influence it c. adjusts until the quantity supplied by all sellers is equal to the quantity demanded by all buyers d. is not influenced by the cost structure of the firms in the market e. is not influenced by the preferences of the consumers in the market

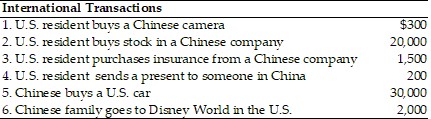

Based on the transactions in the above table, what is the change in the U.S. financial account?

Based on the transactions in the above table, what is the change in the U.S. financial account?

A. -$20,000 B. $9,800 C. -$20,200 D. $10,000