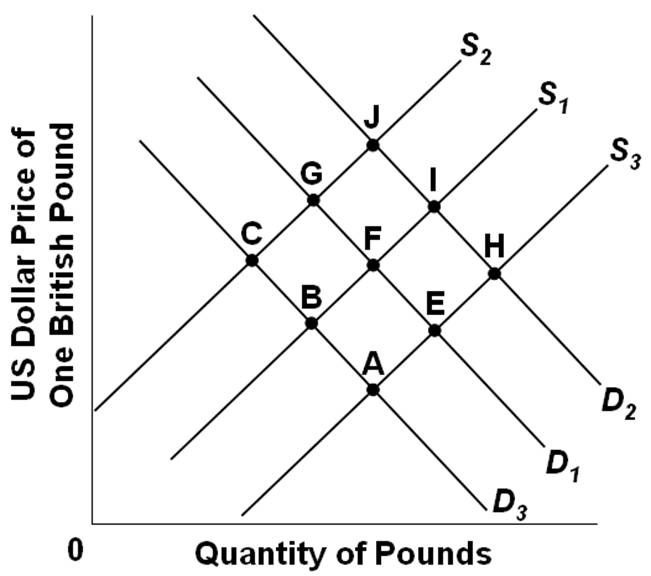

Refer to the graph below, which shows the supply and demand for British pounds. D1 and S1 represent the initial demand and supply curves. If the supply of British pounds in the foreign exchange market shifts to S3, and the British government wanted to fix the exchange rate at its initial level, then it should:

A. Sell U.S. dollars out of its reserves

B. Buy U.S. dollars to add to its reserves

C. Sell British pounds in the foreign exchange market

D. Buy British bonds in the open market

A. Sell U.S. dollars out of its reserves

You might also like to view...

Suppose Russia's inflation rate is 200% over one year but the inflation rate in Switzerland is only 2%. According to relative PPP, what should happen over the year to the Swiss franc's exchange rate against the Russian ruble?

What will be an ideal response?

If the interest rate dropped, what would be the effect on spending?

a. Spending on automobiles would decrease. b. Business spending on new capital would decrease. c. Spending on consumer durables would decrease. d. Business spending on new factories would increase. e. Spending on new homes would decrease.

When the marginal product of an input is ______ than the average product, the marginal units of the input _____ the average product.

A. larger; lower B. smaller; raise C. smaller; do not affect D. larger; raise

If an increase in the price of blue jeans leads to an increase in the demand for tennis shoes, then blue jeans and tennis shoes are

a. substitutes b. complements c. normal goods d. inferior goods e. none of the above