Tax-exempt bonds:

A. generate higher returns for the bondholder when purchased through a tax-exempt retirement account.

B. are most beneficial to those who pay higher income tax rates.

C. are not affected by changes in yields on taxable bonds.

D. include U.S. Treasury securities because the Internal Revenue Service does not charge income tax on interest earned from these bonds.

Answer: B

You might also like to view...

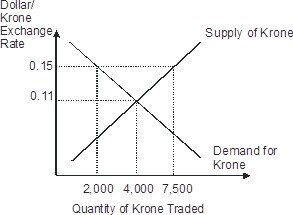

Based on this figure, if the krone exchange rate is fixed at $0.09 dollars per krone, the krone is ________.

A. revalued B. overvalued C. devalued D. undervalued

Which of the following statements is true?

A) Social planners are only concerned with efficiency and not equity. B) Social planners are only concerned with equity and not efficiency. C) To some, efficiency means an even distribution of goods across society. D) To some, equity means an even distribution of goods across society.

A demand curve generally

a. is a straight horizontal line. b. is a straight vertical line. c. slopes downward to the right. d. slopes downward to the left.

With two-part pricing

A) the consumer puts down a deposit and then pays the rest when she picks up the goods purchased. B) the average price paid varies with the number of units purchased. C) the consumer is limited in the number of units that can be purchased. D) consumers are required to buy two units of a good.