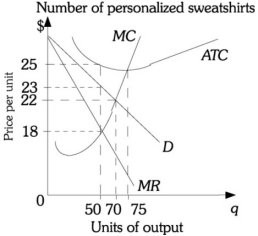

Refer to the information provided in Figure 15.4 below to answer the question(s) that follow.  Figure 15.4 Refer to Figure 15.4. Assume The Hand Made Shirt Shop has fixed costs of $90 and is a monopolistically competitive firm. To maximize profits in the short run, the firm should produce ________ personalized sweatshirts.

Figure 15.4 Refer to Figure 15.4. Assume The Hand Made Shirt Shop has fixed costs of $90 and is a monopolistically competitive firm. To maximize profits in the short run, the firm should produce ________ personalized sweatshirts.

A. 0

B. 50

C. 70

D. 75

Answer: A

You might also like to view...

Loans that are secured against an asset:

A. generally have lower interest rates. B. generally have higher interest rates. C. are much longer in length than unsecured loans. D. are much shorter in length than unsecured loans.

If inflation was zero percent, nominal interest rates would be:

A. larger than real interest. B. equal to real interest rate. C. at the optimal rate. D. smaller than real interest.

Suppose you withdraw $1,000 from your checking account. If the reserve requirement is 20 percent, how does this transaction affect the supply of money and the excess reserves of your bank?

a. There is no change in the supply of money; your bank's excess reserves are reduced by $800. b. There is no change in the supply of money; your bank's excess reserves are reduced by $200. c. The money supply increases by $1,000 . and the excess reserves of your bank are reduced by $800. d. The money supply increases by $1,000 . and the excess reserves of your bank are reduced by $200.

Which of the following statements is true about purchasing power parity (PPP)?

a. PPP is the normal state between two nations because international markets are perfectly competitive. b. PPP is the normal state between two nations because of government regulations and central bank intervention. c. PPP is the normal state between two nations because interest rates, the spot exchange rate, and the forward exchange rate all adjust to create this condition. d. PPP is the normal state between two nations because arbitrageurs take advantage of any imbalances. e. PPP is rarely the case for most nations in the short-run, but exchange rates tend to move in the direction of PPP in the long run.