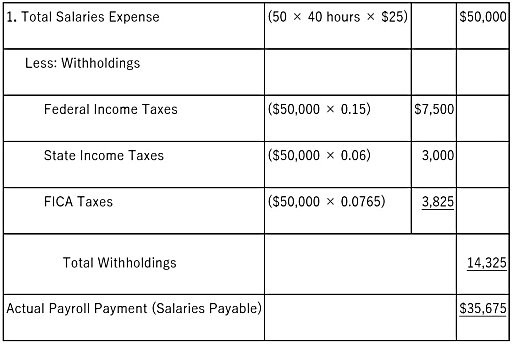

Accurate Reports has 50 employees each working 40 hours per week and earning $25 an hour. Federal income taxes are withheld at 15% and state income taxes at 6%. FICA taxes are 7.65% of the first $128,400 earned per employee and 1.45% thereafter. Unemployment taxes are 3.8% of the first $7,000 earned per employee.1. Compute the total salaries expense, the total withholdings from employee salaries, and the actual payroll payment (salaries payable) for the first week of January.2. Compute the total payroll tax expense Accurate Reports will pay for the first week of January.

What will be an ideal response?

| 2. FICA Taxes | ($50,000 × 0.0765) | $3,825 |

| Unemployment Taxes | ($50,000 × 0.038) | 1,900 |

| Total Payroll Tax Expense | ? | $5,725 |

You might also like to view...

Under the indirect method, an increase in accounts payable is added to net income to determine cash flow from operating activities

a. True b. False Indicate whether the statement is true or false

A Korean factory has offered to supply Fastec with ready-made units for a price of $14 per transfer case. Assume that Fastec's fixed costs are unavoidable, but that Fastec could use the vacated production facilities to earn an additional $9500 of profit per month. If Fastec decides to outsource, monthly operating income will ________.

Fastec Automobile Company fabricates automobiles. Each vehicle includes one transfer case, which is currently made in-house. Details of the transfer case fabrication are as follows:

A) increase by $4700

B) decrease by $15,000

C) increase by $9500

D) decrease by $27,100

Because employee wellness programs are considered employee welfare plans, there is some concern that ______ might apply.

A. FMLA B. OSHA C. ERISA D. ACA

The Anticybersquatting Consumer Protection Act is a:

A) State uniform model act. B) Federal Trade Commission rule. C) Consumer Product Safety Commission rule. D) Federal statute. E) Treaty.