The Social Security tax is considered to be a

A) regressive tax.

B) progressive tax.

C) proportional tax.

D) marginal tax.

Answer: A

You might also like to view...

Economists refer to the talents, training, and education of workers as

A. physical capital. B. average labor productivity. C. human capital. D. labor supply.

Which of the following describes a situation in which demand must be inelastic?

a. The price of pens rises by 10 cents, and quantity of pens demanded falls by 50. b. The price of pens rises by 10 cents, and total revenue rises. c. A 20 percent increase in the price of pens leads to a 20 percent decrease in the quantity of pens demanded. d. Total revenue does not change when the price of pens rises. e. Total revenue decreases when the price of pens rises.

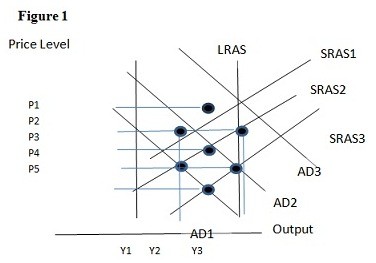

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD1 the result in the long run would be:

A. P4 and Y1. B. P4 and Y2. C. P5 and Y1. D. P5 and Y2.

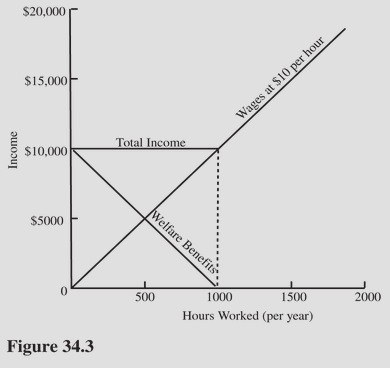

Refer to Figure 34.3. The disincentive to work caused by this welfare program

Refer to Figure 34.3. The disincentive to work caused by this welfare program

A. Exists at all income levels. B. Ends as soon as any income is earned. C. Ends at $10,000. D. Ends at $5,000 where benefits equal wages.