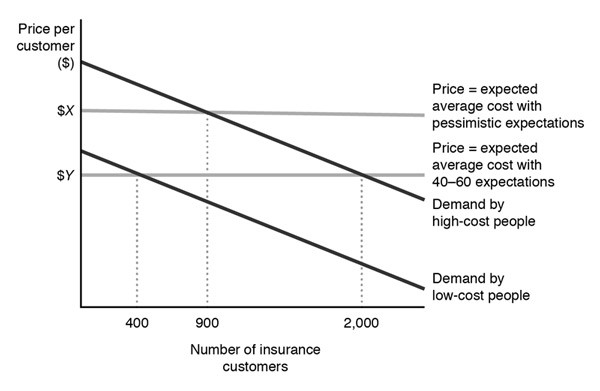

Figure 9.6 represents the market for health insurance. Suppose there are two types of consumers, low-cost consumers with $2,000 average medical expenses per year, and high-cost customers with $4,000 average medical expenses per year. If $Y is the price the insurance company would charge if it expected 40% of its customers to be high-cost, the price it would charge if it expected 50% of its customers to be high-cost would be:

Figure 9.6 represents the market for health insurance. Suppose there are two types of consumers, low-cost consumers with $2,000 average medical expenses per year, and high-cost customers with $4,000 average medical expenses per year. If $Y is the price the insurance company would charge if it expected 40% of its customers to be high-cost, the price it would charge if it expected 50% of its customers to be high-cost would be:

A. greater than $Y.

B. less than $Y.

C. equal to $Y.

D. 50% of $Y.

Answer: A

You might also like to view...

If two goods are complements, their cross elasticity of demand will normally be

A. zero. B. a negative number. C. a positive number. D. infinity.

When the percentage change in the quantity supplied is less than the percentage change in price, the supply is

A) elastic. B) inelastic. C) unit elastic. D) perfectly unit elastic. E) perfectly elastic.

The concept of limited liability says a stockholder of a corporation:

A. cannot lose more than his/her investment. B. cannot receive dividends that exceed his/her investment. C. is only responsible for any taxes that the corporation may owe but not its other debts. D. is liable for the corporation's liabilities, but nothing more.

Which of the following is NOT an important determinant of collusion in pricing games?

A. The number of firms B. All the statements associated with this question are important. C. The importance and magnitude of the item in a consumers' budget D. History