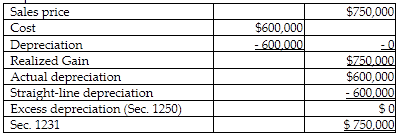

Marta purchased residential rental property for $600,000 on January 1, 1985. Total ACRS deductions for 1985 through the date of sale amounted to $600,000. If the straight-line method of depreciation had been used, depreciation would have been $600,000. The property is sold for $750,000 on January 1 of the current year. The amount and character of the gain is

A) $750,000 Sec. 1231 gain.

B) $150,000 Sec. 1231 gain and $600,000 ordinary income.

C) $750,000 ordinary gain due to Sec 1245.

D) $750,000 ordinary gain due to Sec. 1250.

A) $750,000 Sec. 1231 gain.

Note that Sec. 1245 does not apply to this ACRS building because it is a residential rental building.

You might also like to view...

Positive variance on an S-curve represents significant project progress

Indicate whether the statement is true or false

Relative to CR, _________________ highlights the conflict between managerial and shareholder interests.

a. discipline b. crisis c. regulatory litigation d. C suite power struggles

With experience, unit costs of production decline as ________ increases in most industries.

A. costs B. output C. price D. volume

Donnie is paid a salary of $15,000. At the end of November, his cumulative gross earnings were $99,000. How much will his employer take out for the OASDI portion of social security for December? (Round your final answer to the nearest dollar.)

A) $930.00 B) $1,147.50 C) $217.50 D) $810.00