Suppose two firms operate under a system of marketable pollution permits. If it costs Firm A $25 to reduce pollution by 1,000 units per day, and Firm B can reduce costs by $35 by increasing pollution by 1,000 units per day:

A. the firms cannot gain by trading the right to pollute.

B. both firms can benefit if Firm A trades the right to pollute 1,000 units to Firm B for $30.

C. both firms can benefit if Firm A trades the right to pollute 1,000 units to Firm B for $40.

D. both firms can benefit if Firm B trades the right to pollute 1,000 units to Firm A for $30.

Answer: B

You might also like to view...

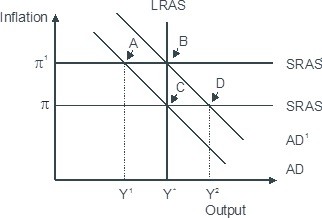

Based on the figure below. Starting from long-run equilibrium at point C, an increase in government spending that increases aggregate demand from AD to AD1 will lead to a short-run equilibrium at point ________ creating _____gap.

A. D; an expansionary B. B; no output C. B; expansionary D. A; a recessionary

The kinked demand curve model explains pricing in monopoly markets.

Answer the following statement true (T) or false (F)

Which of the following is not included as net income in the U.S. balance of payments?

a. Foreign dividends received by U.S. residents. b. Profits earned by U.S. companies from foreign operations and reinvested abroad. c. U.S. interest paid to foreigners. d. Income paid by a U.S. company to foreign consultants. e. All the above are included as net income in the U.S. balance of payments.

Converting corn into ethanol is most profitable when there is/are:

a. High ethanol prices and low corn prices b. Low ethanol prices and low corn prices c. Low ethanol prices and high corn prices d. When the amount of ethanol produced approaches the limits of the amount required in production of gasoline blended with 10% ethanol (the current "blend wall") e. Restricted expansion of ethanol production capacity