How can a buyer of car insurance help in reducing the effects of adverse selection?

What will be an ideal response?

Adverse selection occurs in the insurance market due to asymmetric information. A buyer of car insurance knows about his/her ability to drive a car and hence the likelihood of having an accident, while the insurer does not. A buyer can reduce this information asymmetry by signaling the insurer about his/her abilities as a driver, for example, by passing driving competency tests.

You might also like to view...

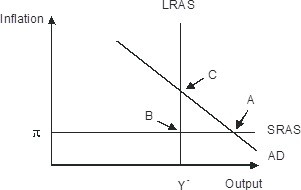

The economy pictured in the figure has a(n) ________ gap with a short-run equilibrium combination of inflation and output indicated by point ________.

A. recessionary; A B. recessionary; C C. recessionary; B D. expansionary; A

Although some economists believe network externalities are important barriers to entry, other economists disagree because

A) they believe that the dominant positions of firms that are supposedly due to network externalities are to a greater extent the result of economies of scale. B) they believe that most examples of network externalities are really barriers to entry caused by the control of a key resource. C) network externalities are really negative externalities. D) they believe that the dominant positions of firms that are supposedly due to network externalities are to a greater extent the result of the efficiency of firms in offering products that satisfy consumer preferences.

How did the Fed peg interest rates during World War 2?

A) by setting a low federal funds rate B) by agreeing to purchase any bonds that were not purchased by private investors C) through extensive use of discount loans D) through nationalization of the banking system

A photograph processing machine company requiring customers who buy a processing machine to purchase chemicals and photographic paper from it is an example of

A) bundling. B) a requirement tie-in sale. C) quantity discrimination. D) a two-part tariff.