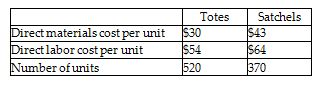

Borsetta, Inc. manufactures two kinds of bags—totes and satchels. The company allocates manufacturing overhead using a single plantwide rate with direct labor cost as the allocation base. Estimated overhead costs for the year are $25,500. Additional estimated information is given below.

Calculate the amount of overhead to be allocated to Satchels, if the actual units produced and direct labor costs equal the estimated amounts. (Round any percentages to two decimal places and your final answer to the nearest dollar.)

A) $472

B) $13,835

C) $11,667

D) $23,680

C) $11,667

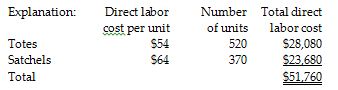

Predetermined overhead allocation rate = Total estimated overhead costs / Total estimated quantity of the overhead allocation base = $25,500 / $51,760 = 49.27% of direct labor cost

Manufacturing overhead cost allocated to Satchels = $23,680 × 49.27% = $11,667

You might also like to view...

A coal mine cost $1,009,000 and is estimated to hold 57,000 tons of coal. There is no residual value. During the first year of operations, 12,000 tons are extracted and sold. Calculate depletion per unit. (Round your answer to the nearest cent.)

A) $8.85 B) $4.43 C) $17.70 D) $13.27

T-accounts have a left, or credit, side and a right, or debit, side

Indicate whether the statement is true or false

A remainder is a future interest in one other than the grantor

Indicate whether the statement is true or false

An asset is purchased on January 1 for $44,200. It is expected to have a useful life of four years after which it will have an expected residual value of $5900. The company uses the straight-line method. If it is sold for $31,800 exactly two years after it is purchased, the company will record a:

A. gain of $6750. B. gain of $5650. C. loss of $5650. D. loss of $6750.