All of the following are governmental efforts to decrease poverty EXCEPT

A. tariffs.

B. Supplemental Security Income.

C. the earned income program.

D. transfer payments.

Answer: A

You might also like to view...

If the Fed were to attempt to increase the money supply, it would most likely do so

A) by manipulating the discount rate. B) by manipulating the required reserve ratio. C) by altering the amount of gold held in Fort Knox. D) by engaging in open market operations.

Policymakers focus on marginal tax rate changes when making changes in the tax code because the marginal tax rate

A) determines how tax revenue will change as national income increases. B) determines how much revenue the government will have to spend. C) always equals the average tax rate which is harder to measure. D) affects people's willingness to work, save, and invest.

A freeze that destroys all of the Florida orange crop would result in

a. a lower price for orange juice as people will switch to Texas grapefruit juice b. a higher price for orange juice as people demand more orange juice c. no change in the price for orange juice d. a higher price for orange juice due to the decrease in supply of oranges e. a higher price for orange juice due to the increase in demand for oranges

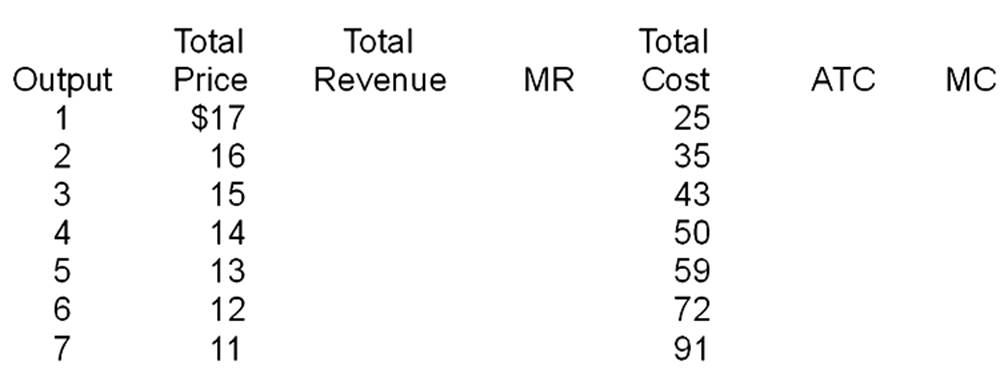

Fill in the table.