What do we call financial institutions through which savers can indirectly provide funds to borrowers?

a. stock markets

b. financial institutions

c. financial markets

d. financial intermediaries

d

You might also like to view...

The table below shows data for the United States

Nominal Interest Rate Inflation Rate 2013 5.25 4 2014 5 2 2015 4.5 4.3 Between 2013 and 2014, the real interest rate ________ and caused a ________ the demand for loanable funds curve. A) increased; rightward shift B) decreased; leftward C) increased; movement upward along D) decreased; downward along

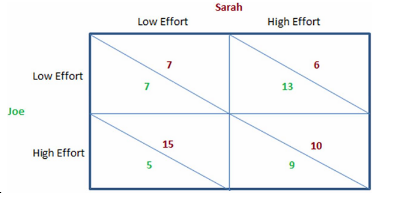

According to the figure shown, Sarah:

This figure shows the payoffs involved when Sarah and Joe work on a school project together for a single grade. They both will enjoy a higher grade when more effort is put into the project, but they also get pleasure from goofing off and not working on the project. The payoffs can be thought of as the utility each would get from the effort they individually put forth and the grade they jointly receive.

A. should put forth low effort, regardless of what Joe chooses to do.

B. should put forth high effort, regardless of what Joe choose to do.

C. does not have a dominant strategy.

D. should take the first-mover advantage and put forth low effort.

We calculate many different kinds of price indexes:

A. in order to capture a complete picture of how price changes are affecting the economy. B. to see how the prices of different groups of goods are changing. C. to measure how different groups of people in the economy are being affected by changing prices. D. All of these statements are true.

Assuming that households do not change their cash holdings and banks loan out all of their excess reserves, if the required reserve ratio (RRR) is 20 percent and the Fed purchases $2,000 worth of bonds from banks, how much money will be eventually created?

a. $1,800 b. $2,000 c. $10,000 d. $18,000 e. $20,000