According to the negative income tax, the breakeven income level for a program whose tax credit is $3,000 and whose tax rate is 30 percent would be

A. $4,500.

B. $9,000.

C. $10,000.

D. $6,000.

Answer: C

You might also like to view...

Which of the following will lower the money multiplier?

a. An increase in the currency/checkable deposit ratio b. A decrease in the excess reserve/checkable deposit ratio c. A decrease in the required reserve/checkable deposit ratio d. Either a or b e. All of the above

All of the following will increase the demand for labor by firms in an industry except

A. an increase in the price of the product produced by the industry. B. a decrease in the prices of inputs that substitute for labor. C. an increase in the marginal product of labor resulting from technological change. D. an increase in the demand for the product produced by the industry.

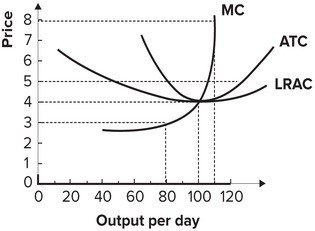

Refer to the graph shown, which depicts a perfectly competitive firm. When the industry is in long-run competitive equilibrium:

A. the price of the product will be $6. B. the firm will produce 100 units of output. C. the marginal cost of production will be $3. D. the firm will earn economic profits of $300 per day.

The ratio at which one country trades a domestic product for imported product is that country's

A. comparative advantage. B. cost ratio. C. terms of trade. D. absolute advantage.