Paper Corporation holds 80 percent of the voting shares of Scissor Company. On January 1, 20X8, Scissor purchased $100,000 par value 12 percent first mortgage bonds of Paper from Cruse for $115,000. Paper originally issued the bonds to Cruse on January 1, 20X6, for $110,000. The bonds have an 8-year maturity from the date of issue. Scissor's reported net income of $65,000 for 20X8, and Paper reported income (excluding income from ownership of Scissor's stock) of $90,000.Based on the information given above, what gain or loss on the retirement of bonds should be reported in the 20X8 consolidated income statement?

A. $6,250 gain

B. $7,500 loss

C. $7,500 gain

D. $6,250 loss

Answer: B

You might also like to view...

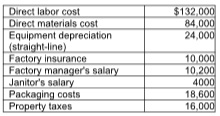

From the above information, calculate Tentacle's total fixed costs.

Tentacle Television Antenna Company provided the following manufacturing costs for the month of

June.

A) $298,800

B) $40,200

C) $60,200

D) $64,200

_____ allow several people in different roles to contribute new content and edit existing content; sometimes even guests or visitors can play a role

Fill in the blank(s) with correct word

In bailment cases, exculpatory clauses:

a. are very rarely used. b. are somewhat more likely to be enforced than in other types of cases. c. ordinarily involve an attempt to limit liability for damage to persons rather than property. d. None of the above.

The federal court system consists of three levels

Indicate whether the statement is true or false