Suppose a tax of $3 per unit is imposed on a good. The supply curve is a typical upward-sloping straight line, and the demand curve is a typical downward-sloping straight line. The tax decreases consumer surplus by $3,900 and decreases producer surplus by $3,000 . The tax generates tax revenue of $6,000 . The tax decreased the equilibrium quantity of the good from

a. 2,000 to 1,500.

b. 2,400 to 2,000.

c. 2,600 to 2,000.

d. 3,000 to 2,400.

c

Economics

You might also like to view...

When discussing issues of pollution, it is clear that

A) since polluters are harming other people they must be made to stop polluting. B) we can easily delineate who is the victim and who is the villain. C) the most efficient amount of pollution is no pollution at all. D) None of the above are true.

Economics

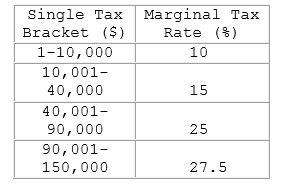

For a person earning $15,000, the average tax rate is:

A. 10%

B. 15%

C. 12.5%

D. 11.7%

Economics

A bond is essentially:

A. an equity. B. a loan. C. a stock. D. a derivative.

Economics

If you were going to evaluate the wisdom of an investment made now that created a stream of profits in the future, which Excel function would help you calculate it?

A. Sum B. Invest C. PV D. Profit

Economics