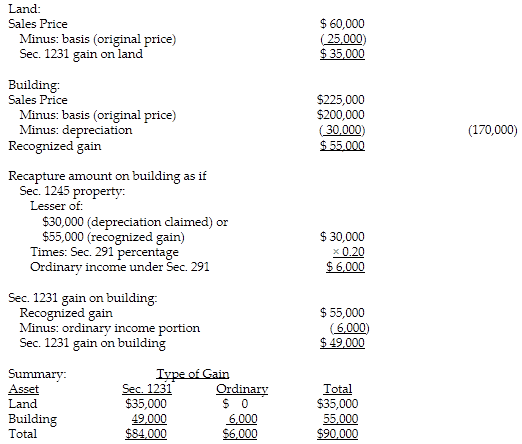

James Corporation purchased residential real estate in 2012 for $225,000, of which $25,000 was allocated to land and $200,000 was allocated to the building. James Corporation took straight-line MACRS deductions of $30,000 during the years 2012-2017. In 2018, James Corporation sold the property for $285,000, of which $60,000 is allocated to the land and $225,000 is allocated to the building. What

are the amounts and character of James Corporation's recognized gain or loss on the sale?

What will be an ideal response?

Business

You might also like to view...

Examples of personal needs include accomplishment, fun, freedom, and relaxation.

Answer the following statement true (T) or false (F)

Business

Isaac is looking for ways to offer new goods and services to his existing customers. He is pursuing a market development strategy.

Answer the following statement true (T) or false (F)

Business

Brokers have no fiduciary duties with regard to earnest money on deposit

Indicate whether the statement is true or false

Business

If you specify NOT NULL for a column when you create a table, you are prohibited from changing a value in the column to null

a. True b. False Indicate whether the statement is true or false

Business