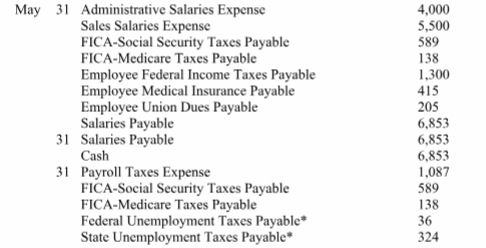

On May 31 the company issued Check No. 4625 payable to the Payroll Bank Account to pay for the May payroll. It issued payroll checks to the employees after depositing the check. (1) Prepare the journal entry to record (accrue) the employer's payroll for May. (2) Prepare the journal entry to record payment of the May payroll. The federal and state unemployment tax rates are 0.6% and 5.4%, respectively, on the first $7,000 paid to each employee. The wages and salaries subject to these taxes were $6,000. (3) Prepare the journal entry to record the employer's payroll taxes.

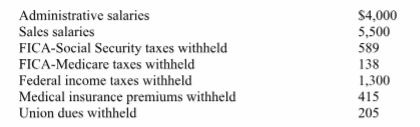

A company's payroll information for the month of May follows:

*$6,000 * 0.006 = $36.

*$6,000 * 0.054 = $324.

You might also like to view...

How are trade receivables used in the calculation of each of the following? Current Ratio Inventory Turnover

a. Not used Numerator b. Numerator Numerator c. Numerator Not used d. Denominator Numerator

A group of states that have reduced or eliminated trade barriers among themselves but maintain their individual tariffs in dealing with other states is called ________

A. a customs union B. a free trade area C. the United Nations System D. an economic consultative association

Which of the following should be avoided when writing for web users?

a. Write the main idea or conclusion first, followed by details. b. Write in complete sentences. c. List the items in columns rather than in rows. d. Write directions in numbered steps.

A growth trap occurs when a company needs cash faster than can be generated in profits.

Answer the following statement true (T) or false (F)