As a result of a tariff on imports, consumers in the importing country

a. purchase more domestically produced goods and fewer foreign goods, resulting in the consumption of fewer total goods than without the tariff

b. purchase more domestically produced goods and fewer foreign goods, resulting in the consumption of more total goods than without the tariff

c. purchase more domestically produced goods and more foreign goods, resulting in the consumption of fewer total goods than without the tariff

d. purchase fewer domestically produced goods and fewer foreign goods, resulting in the consumption of more total goods than without the tariff

e. cease importing any goods at all

A

You might also like to view...

A perfectly competitive firm trying to maximize profits in the short run will expand output

A. until total revenue equals total cost. B. until marginal cost equals average variable cost. C. until marginal cost begins to rise. D. as long as marginal revenue is greater than marginal cost.

If a tax is imposed on a market with inelastic demand and elastic supply, then

A. it is impossible to determine how the burden of the tax will be shared. B. sellers will bear most of the burden of the tax. C. the burden of the tax will be shared equally between buyers and sellers. D. buyers will bear most of the burden of the tax.

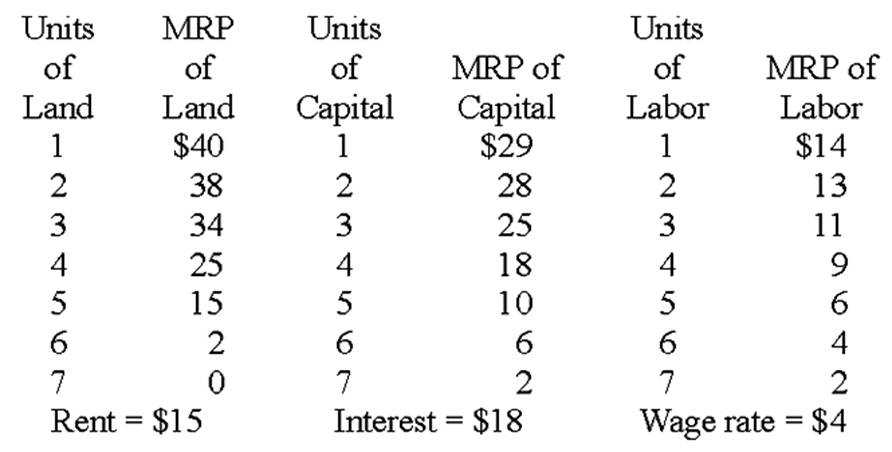

How many units of capital would you hire?

The process of dividing a nominal quantity by a price index in order to express the quantity in real terms is called:

A. negative inflation. B. indexing. C. depressing. D. deflating.