A bond is a financial security that represents

A) the portion of profits paid to shareholders. B) ownership in a corporation.

C) the interest rate paid on a share of stock. D) a promise to repay a fixed amount of funds.

D

You might also like to view...

When there is positive inflation,

A) growth in nominal GDP exceeds growth in real GDP. B) growth in real GDP exceeds growth in nominal GDP. C) growth in real GDP and nominal GDP are roughly equal. D) there can never be any growth in nominal GDP.

The federal funds rate is

a. the minimum rate associated with the amount of reserves the Fed requires a bank to hold b. the interest rate that the Fed charges banks who borrow from it c. the interest rate charged by banks that lend reserves to other banks for short periods of time d. the maximum rate of the price of a stock that can be borrowed from a bank, with the stock offered as collateral e. an appeal by the Fed to banks, asking for voluntary compliance with the Fed's policies concerning interest rates

When the Fed buys government bonds on the open market from commercial banks, the

a. assets of these banks fall b. assets of the Fed falls c. assets of the banks rise d. liabilities of the bank rise e. liabilities of the bank fall

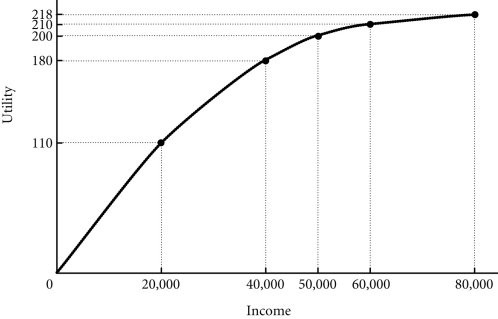

Refer to the information provided in Figure 17.1 below to answer the question(s) that follow.  Figure 17.1 Refer to Figure 17.1. Dmitri has two job offers when he graduates from college. Dmitri views the offers as identical, except for the salary terms. The first offer is at a fixed annual salary of $40,000. The second offer is at a fixed salary of $20,000 plus a possible bonus of $40,000. Dmitri believes that he has a 50-50 chance of earning the bonus. Dmitri's expected value from the first job offer is ________ and is ________ from the second job offer.

Figure 17.1 Refer to Figure 17.1. Dmitri has two job offers when he graduates from college. Dmitri views the offers as identical, except for the salary terms. The first offer is at a fixed annual salary of $40,000. The second offer is at a fixed salary of $20,000 plus a possible bonus of $40,000. Dmitri believes that he has a 50-50 chance of earning the bonus. Dmitri's expected value from the first job offer is ________ and is ________ from the second job offer.

A. $40,000; $40,000 B. $40,000; $60,000 C. $20,000; $40,000 D. $40,000; $50,000