Suppose coal sells for $50 per ton and can be mined at a constant marginal cost of $20 per ton. Forecasters predict that the price of coal next year will be $55. If your marginal cost next year will still be $20 and the interest rate is 10%, do you sell coal today?

What will be an ideal response?

You are indifferent if coal prices rise (10% of 50 - 20 ) by $3. Since coal prices are expected to rise by $5, you will wait until next year.

You might also like to view...

Many colonists believed that export surpluses with England positively impacted colonial businesses through increased prices and profits

Indicate whether the statement is true or false

Is it possible for sellers to benefit more than consumers from a subsidy to buyers?

A. Yes, if the sellers need it more. B. Yes, if the supply curve is relatively less elastic than the demand curve. C. Yes, if the supply curve is relatively more elastic than the demand curve. D. Producers can never benefit more than buyers from a subsidy to buyers.

Carlos has been invited to go skiing for the afternoon with his friends. It will cost $40 for a lift ticket. It is likely Carlos will:

A. overvalue the benefit of skiing. B. find it difficult to place a value on what he might do instead of skiing. C. undervalue the opportunity cost of his afternoon. D. All of these are true.

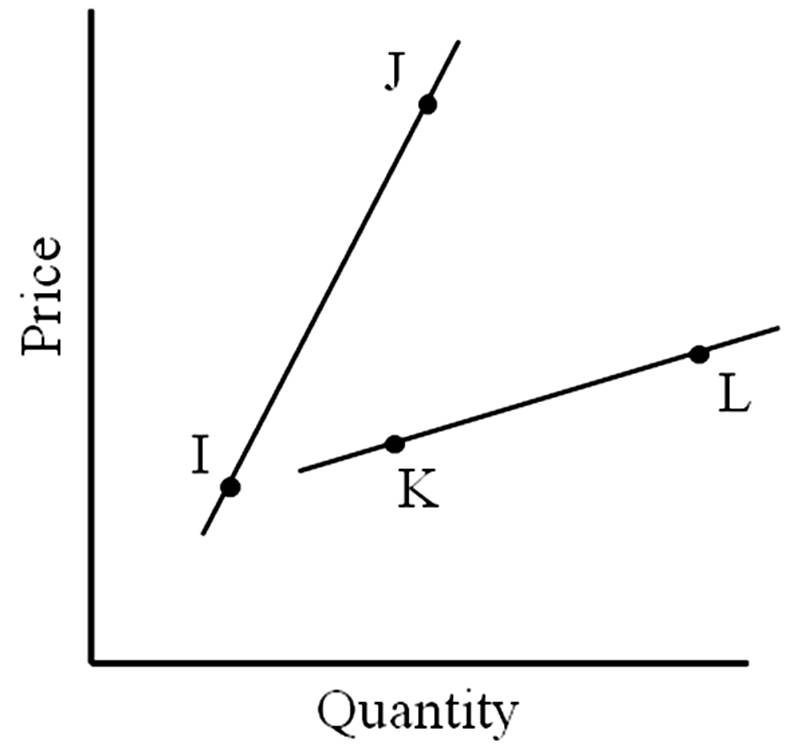

A move from J to K represents

A. a change in quantity supplied.

B. no change in supply.

C. an increase in supply.

D. a decrease in supply.