Quality Corporation, a regular corporation, has an opportunity to realize $50,000 of additional income in either the current year or next year. What tax issues need to be considered in determining when to realize the income?

What will be an ideal response?

• What is Quality's current-year taxable income?

• What is Quality's expected taxable income next year?

• What is Quality's marginal tax rate this year?

• What is Quality's expected marginal tax rate next year?

• Is Quality in the 5% surtax range this year or next year?

You might also like to view...

When testing a standard cost system, the auditor does not normally make which of the following inquiries?

a. The method for developing standard costs. b. The method for identifying components of overhead and of allocating overhead to products. c. The method for identifying sales cutoff. d. The method used for allocating variances to inventory and cost of goods sold.

While the major objective of the Federal income tax law is to raise revenue, social considerations and economic objectives also affect the tax law.

Answer the following statement true (T) or false (F)

You recently purchased a sweater from an online retailer's website. You engaged in

A) e-commerce. B) e-dealing. C) e-business. D) e-action.

What would be the amount appearing on the December 31, 2018 Consolidated Statement of Financial Position for land?

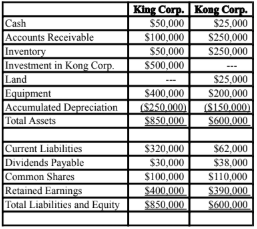

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, which it acquired on January 1, 2018. The Financial Statements of King Corp. and Kong Corp. for the Year ended December 31, 2018 are shown below:

Income Statements

Retained Earnings Statements

Balance Sheets

Other Information:

> King sold a tract of Land to Kong at a profit of $10,000 during 2018. This land is still the property of Kong Corp.

> On January 1, 2018, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

> On January 1, 2018, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2018, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

> Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

> Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

• Inventory had a fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2018.

• A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

• There was a goodwill impairment loss of $4,000 during 2018.

• Both companies are subject to an effective tax rate of 40%.

• Both companies use straight line amortization.

A) $25,000. B) $21,000. C) $15,000. D) $17,000.