Assume the MARR is 10% per year for this analysis. A presently owned machine that was purchased 8 years ago for $450,000 is under consideration for replacement. It has an annual operating cost of $120,000 per year and a salvage value of $40,000 whenever it is replaced. The challenger has a first cost of $670,000, an expected annual operating cost of $94,000, and a salvage value of $60,000 after its 10-year economic life. The breakeven market value of the presently owned machine required to make the AW values of the two machines the same, if the presently owned machine is kept for 5 more years and then replaced with the challenger that has the same AW, is closest to: (choose one)

(a) $196,340

(b) $255,390

(c) $325,360

(d ) $394,770

-RV(A/P,10%,5) – 120,000 + 40,000(A/F,10%,5) = -670,000(A/P,10%,10) – 94,000

+ 60,000(A/F,10%,10)

-RV(0.26380) – 120,000 + 40,000(0.16380) = -670,000(0.16275) – 94,000

+ 60,000(0.06275)

RV = $325,358

Answer is (c) $325,360

You might also like to view...

18 is 66 2/3 % of ____________________.

Fill in the blank(s) with the appropriate word(s).

? Identify and state the historical significance of Frederick Douglass.

What will be an ideal response?

Each steel column is provided with a base plate. Is the base plate bolted or welded to the column and where ?at the site or in fabricator's shop?

What will be an ideal response?

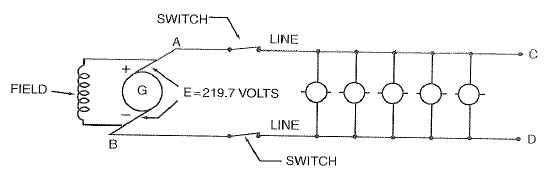

Carry the answer to two decimal places. The voltage at the terminals A and B in the diagram of the electric generator shown is 219.7 volts, and the voltage drop (loss in the line) is 3.96 volts. What is the voltage at the end of the line at points C and D?

Fill in the blank(s) with the appropriate word(s).