How do depository institutions create liquidity, pool risks, and lower the cost of borrowing?

What will be an ideal response?

Liquidity is the property of being easily convertible into a means of payment without loss in value. Depository institutions create liquidity when they offer deposits that can be withdrawn as money at short (or no) notice and then use these deposits to make long-term loans.

Depository institutions pool risk because they use funds obtained from many depositors to make loans to many borrowers. As a result, if a borrower defaults, no one depositor bears the entire loss because the loss is spread over all depositors. By spreading the risk, depository institutions are pooling risk.

Depository institutions lower the cost of borrowing because they specialize in borrowing. For instance, a firm that wants to borrow a large sum of money need only visit one depository institution to arrange such a loan. In the absence of depository institutions, the firm would need to undertake many transactions with many lenders, which would be a costly process.

You might also like to view...

The distinguishing characteristic of a public good is

A) noncompetitive production. B) durability. C) exclusivity. D) nonrival consumption.

If the price of Pepsi-Cola increases from 40 cents to 50 cents per can and the quantity demanded decreases from 100 cans to 50 cans, then, according to the midpoint formula, the value of price elasticity of demand for Pepsi-Cola is

a. -0.5 b. -0.25 c. -1 d. -3 e. -2

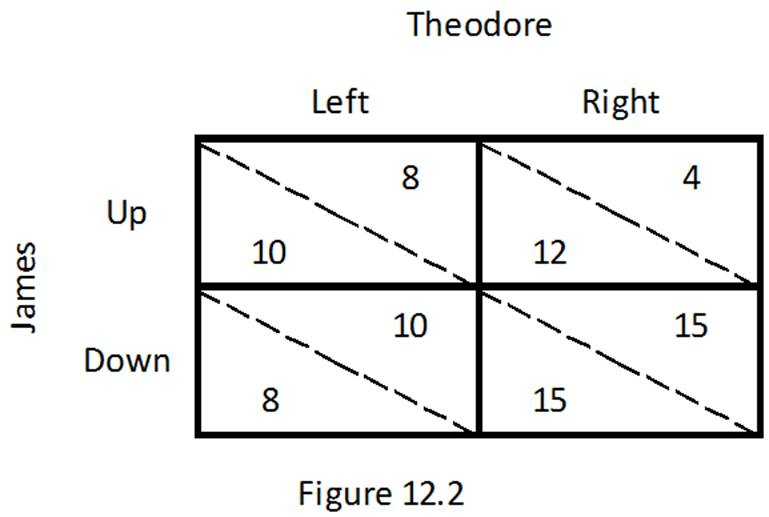

Refer to the game between James and Theodore depicted in Figure 12.2. Which of the following is true?

A. If James chooses Up, Theodore's best response is to choose Right.

B. If James chooses Down, Theodore's best response is to choose Left.

C. If Theodore chooses Left, James's best response is to choose Down.

D. If Theodore chooses Right, James's best response is to choose Down.

If the elasticity of demand for sugar cookies is 2.5, then a 10% change in price will lead to a 5% change in quantity demanded.

Answer the following statement true (T) or false (F)