Which of the following federal taxes is earmarked for a specific purpose?

A. Both employment taxes and unemployment taxes are earmarked taxes.

B. Employment taxes

C. Corporate income tax

D. Unemployment taxes

Answer: A

You might also like to view...

What is the correct sequence for closing the temporary accounts?

a. revenues, expenses, Income Summary, Drawing; b. expenses, revenues, Income Summary, Drawing; c. revenues, expenses, Drawing, Income Summary; d. Drawing, revenues, expenses, Income Summary; e. net income, Drawing, Income Summary

Briefly discuss the three interdependent activities that are critical for effective leadership.

What will be an ideal response?

Which of the following is a measure for discouraging theft for a retail store that accepts cash receipts over the counter?

A) A receipt is issued for each transaction to ensure that each sale is recorded. B) At the end of the day, the sales clerk proves the cash by comparing the cash in the drawer against the machine's record of cash sales. C) The sales clerk uses the machine tape to record the journal entry for cash receipts and sales revenue. D) The store clerk deposits the cash in the bank.

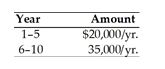

Find the present value of the following stream of a firm's cash flows, assuming that the firm's opportunity cost is 14 percent.

A) $131,068

B) $149,417

C) $485,897

D) $104,322