If taxable income is rising and if the marginal tax rate is greater than the average tax rate, then

A. the average tax rate must be rising.

B. the average tax rate must be falling.

C. the average tax rate may be either rising or falling.

D. the tax is regressive.

A. the average tax rate must be rising.

You might also like to view...

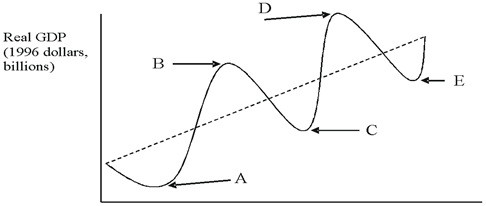

Refer to the figure below.  In the figure, which interval represents a business cycle recession?

In the figure, which interval represents a business cycle recession?

A. A to B B. A to C C. B to C D. B to D

Indifference curves located closer to the origin

a. are less preferred to those located farther away from the origin b. are more preferred to those located farther away from the origin c. cannot be tangent to a budget line d. eventually become straight lines that coincide with the budget line e. represent preferences that are not rational

During the last sixty years, the broad stock market (Standard and Poor's 500 Index) yielded an average annual nominal rate of return of approximately ____ and real rate of return of approximately ____

a. 5 percent; 2 percent b. 10 percent; 7 percent c. 17 percent; 9 percent d. 9 percent; 17 percent

In the long run, firms in a perfectly competitive market:

A. produce a quantity that maximizes profits. B. choose the level of output that minimizes average total costs. C. earn zero economic profit. D. All of these are true.