Darrin Products uses a job-costing system for its units, which pass from the Machining Department, to the Assembly Department, to finished-goods inventory. The Machining Department is heavily automated; in contrast, the Assembly Department performs a number of manual-assembly activities. The company uses machine hours to apply manufacturing overhead to products in the Machining Department, and direct labor cost to apply manufacturing overhead to products in the Assembly Department.The following information relates to the Machining Department for the year just ended:Budgeted manufacturing overhead$12,000,000Actual manufacturing overhead12,142,000Budgeted machine hours 800,000Actual machine hours794,000The Machining Department data that follow pertain to job no. 775, the only job in

production at year-end.Direct materials$125,000Direct labor cost61,800Machine hours550Required: A. Assuming the use of normal costing, calculate the predetermined overhead rate that is used in the Machining Department.B. Compute the cost of the Machining Department's year-end work-in-process inventory.C. Determine the amount that overhead was under- or overapplied during the year in the Machining Department. Indicate whether it is overapplied or underapplied.D. If Darrin disposes of the Machining Department's under- or overapplied overhead as an adjustment to Cost of Goods Sold, would the company's Cost-of-Goods-Sold account increase or decrease? Explain.E. How much overhead would have been charged to the Machining Department's Work-in-Process account during the year?F. Comment on the appropriateness of direct labor cost to apply manufacturing overhead in the Assembly Department.

What will be an ideal response?

A. Machining overhead rate: $12,000,000 ÷ 800,000 hours = $15 per machine hour

B. The ending work in process is carried at a cost of $195,050, computed as follows:

| Direct materials | $125,000 |

| Direct labor cost | 61,800 |

| Manufacturing overhead (550 x $15) | 8,250 |

| Total cost | $195,050 |

C. Actual overhead in the Machining Department amounted to $12,142,000, whereas applied overhead totaled $11,910,000 (794,000 hours × $15). Thus, overhead was underapplied by $232,000 during the year.

D. The department's manufacturing overhead was underapplied by $232,000. As a result of this situation, insufficient overhead flowed from Work in Process, to Finished Goods, to Cost of Goods Sold, meaning that the Cost-of-Goods-Sold account must be increased at year-end.

E. The Work-in-Process account is charged with applied overhead, or $11,910,000.

F. The firm's selection of application bases is likely appropriate. The bases should "drive" the costs, meaning there should be a strong cause-and-effect relationship between the base that is used and the amount of overhead incurred. In the Assembly Department, a considerable portion of the overhead incurred is related to manual-assembly (i.e., labor) operations.

You might also like to view...

This source usually cannot be checked out of the library and is kept apart from other books

A) books B) library databases C) reference materials D) periodicals

A pronoun must agree in number with its antecedent. Explain this rule and provide several examples

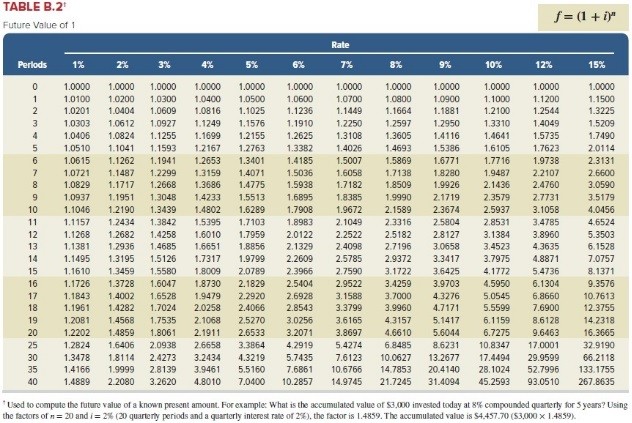

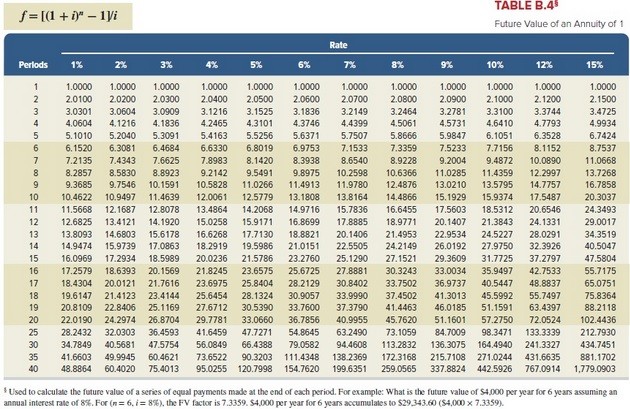

Russell Company has acquired a building with a loan that requires payments of $16,000 every six months for 3 years. The annual interest rate on the loan is 8%. What is the present value of the building? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use

Russell Company has acquired a building with a loan that requires payments of $16,000 every six months for 3 years. The annual interest rate on the loan is 8%. What is the present value of the building? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use

appropriate factor(s) from the tables provided.) A. $83,874 B. $23,262 C. $96,000 D. $41,234 E. $49,676

The Excel function =RAND() generates random numbers that are:

A) greater than 0 B) less than 1 C) between 0 and 0.9999 D) between -1 and 1 E) greater than 1