Imagine that the Fed has unexpectedly lowered the reserve requirement, greatly increasing the amount of money in circulation. Explain what a rational expectations theorist would predict should happen in this situation over both the short run and the long run. Then give an example of what a critic of rational expectations theory would predict instead.

What will be an ideal response?

Student responses will vary but should accurately describe the short and long run effects of an unanticipated expansionary policy, according to both rational expectations theorists and their critics. A sample answer follows. A rational expectations theorist would predict that, in the short run, the unanticipated expansionary policy will cause an expansion in output and employment. However, workers will quickly realize that inflation is driving down their real wages and will demand raises. In the long run, a rational expectations theorist would expect the output level to return to its normal level, but with inflation at a higher rate. A critic of rational expectations theory would agree that the short-run effect of the increased money supply will be higher output and employment. However, he or she would argue that even though workers might realize their real wages are falling, many of them will not be able to do anything about it. They might be under contract or be too easily replaceable to demand higher wages. Thus, a critic would argue, in the long run, output may remain higher than it was originally, along with a higher inflation rate.

You might also like to view...

Producing goods can add to net wealth, but rendering services cannot. Explain.

What will be an ideal response?

Which of the following accurately contrasts consumption and investment?

a. Investment is a much larger component of aggregate demand than consumption. b. Consumption involves government purchases, whereas investment involves household purchases. c. Consumption includes purchases by households, whereas investment includes purchases by firms. d. Investment is more influenced by disposable income than is consumption.

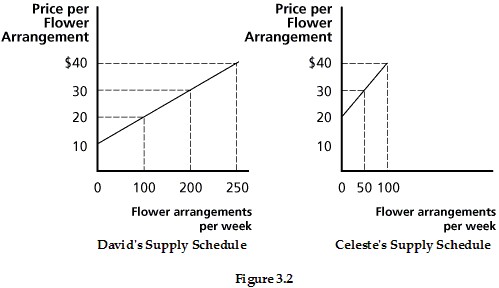

Refer to Figure 3.2, which shows David's and Celeste's individual supply curves for flower arrangements per week. Assuming David and Celeste are the only producers in the market, what is the market quantity supplied at a price of $20?

Refer to Figure 3.2, which shows David's and Celeste's individual supply curves for flower arrangements per week. Assuming David and Celeste are the only producers in the market, what is the market quantity supplied at a price of $20?

A. 0 B. 100 C. 150 D. 200

If a firm in a perfectly competitive industry lowers its price below the market price, its

A. sales will drop to zero. B. profit will decrease. C. total revenue will increase. D. demand curve will become downward sloping.