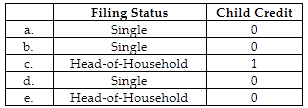

For each of the following taxpayers, indicate the applicable filing status and the number of children who qualify for the child credit.

a. Jeffrey is a widower, age 71, who receives a pension of $10,000, nontaxable social security benefits of $12,000, and interest of $2,000. He has no dependents.

b. Selma is a single, full-time college student, age 20, who earned $6,800 working part-time. She has $1,700 of interest income and received $1,000 support from her parents.

c. Olivia is married, but her husband left her three years ago and she has not seen or heard from him since. She supports herself and her six-year-old daughter. She paid all the household expenses. Her income consists of salary of $18,500 and interest of $800.

d. Ruben is a single, full-time college student, age 20, who earned $6,800 working part-time. He has $250 of interest income and received $10,000 support from his parents.

e. Cathy is divorced and received $12,000 alimony from her former husband and earned $35,000 working as an administrative assistant. She also received $2,500 of child support for her daughter who lives with her. Cathy filed the appropriate IRS form and gave up the dependency exemption to her former husband.

You might also like to view...

What skills and competencies will marketers need to succeed in the future?

What will be an ideal response?

Metro Arcade sells tickets at $25 per person as a one-day entrance fee

Variable costs are $11 per person, and fixed costs are $52,500 per month. Assume that Metro increases variable costs from $11 to $14 per person. Compute the new breakeven point in tickets and in sales dollars. What will be an ideal response

Why would someone choose to use simulation to analyze a waiting line problem rather than use a formula? What are the advantages and disadvantages of a simulation approach?

What will be an ideal response?

Giant Koala Stores Inc has forecasted sales for July through October in the top row of the table. Forecasted collections from cash and credit sales as well as forecasted payments to suppliers are also shown in the table

Wages, general & administrative expenses are 28% of the current month's sales. Giant Koala starts August with a cash balance of $7.61M. What is the cash balance at the end of September? Sales Forecast and Cash Budget Giant Koala Stores Inc ($000,000) July August September October Sales Forecast $27.000 $27.000 $33.000 $32.500 Cash Sales 15.300 22.950 28.050 27.625 Collections from last Month 4.050 4.050 4.950 Total Cash Inflows 27.000 32.100 32.575 Total Payments to Suppliers 17.940 21.418 Wages, General & Admin Expenses 7.560 7.560 9.240 Total Disbursements 25.500 30.658 Net Cash Flows Beginning cash balance $7.610 Plus: Net Cash Flows Ending cash Balance A) $7.61 million B) $8.61 million C) $9.11 million D) $10.55 million E) $11.62 million