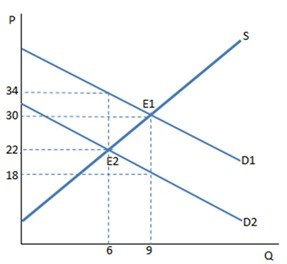

The graph shown demonstrates a tax on buyers. What is the amount of tax revenue being generated from the tax?

The graph shown demonstrates a tax on buyers. What is the amount of tax revenue being generated from the tax?

A. $48

B. $36

C. $72

D. $96

Answer: C

You might also like to view...

Based on the figure below. Starting from long-run equilibrium at point C, a tax cut that increases aggregate demand from AD to AD1 will lead to a short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________, if left to self-correcting tendencies.

A. D; C B. B; C C. B; A D. D; B

Political creative destruction is likely to be opposed:

A) equally in all types of economies. B) more in a market economy than in a command economy. C) more in an economy with inclusive institutions than in an economy with extractive institutions. D) less in an economy with inclusive institutions than in an economy with extractive institutions.

An increase in supply will occur when

A) the supply curve shifts downward to the right. B) the supply curve shifts upward to the left. C) the demand curve shifts downward to the left. D) the demand curve shifts upward to the right.

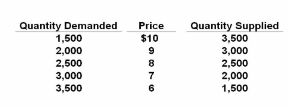

Refer to the given data. If government levies a per-unit excise tax of $1 on suppliers of this product, equilibrium price and quantity will be:

A. $9 and 3,000.

B. $7.50 and 2,250.

C. $8.50 and 2,250.

D. $7 and 3,000.