The best example of a direct tax is a(n)

a. excise tax.

b. liquor tax.

c. sales tax.

d. income tax.

d. income tax.

You might also like to view...

Leo is a welfare recipient who qualifies for two means-tested cash benefit programs. If he does not earn any income, he receives $225 from each program. For each dollar he earns (which his employer is required to report to the welfare agency), his benefit from each program is reduced by 75 cents until the benefit equals zero. In the absence of any earnings, Leo will receive ________ in cash from each program, for a total of ________ in benefits.

A. $225; $450 B. $225; $225 C. $200; $400 D. $225; $400

A variable that is potentially affected by an experimental treatment is referred to as a(n):

A) compulsory variable. B) omitted variable. C) independent variable. D) dependent variable.

Max has allocated $100 toward meats for his barbecue. His budget line and indifference map are shown in the above figure. If Max's current MRS = -0.8, then Max is at point

A) b. B) d. C) e. D) None of above.

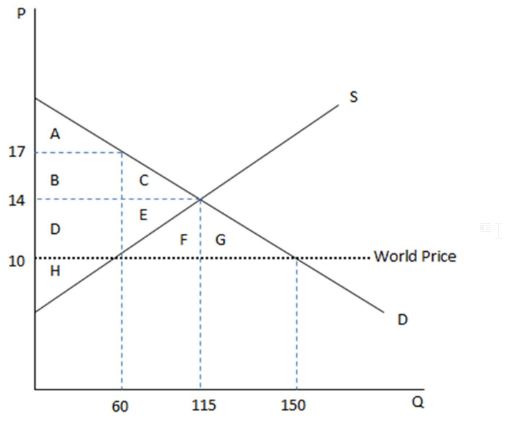

According to the graph shown, if this economy were to engage in free trade, the good would:

This graph demonstrates the domestic demand and supply for a good, as well as the world price for that good.

A. be imported.

B. be exported.

C. no longer be produced domestically.

D. not be imported or exported and only be produced domestically.