Suppose the equilibrium level of income exceeds the full employment level of income and there is high inflation. Hence, the government decides to implement a fiscal policy that will act to reduce national output and prices. This can be accomplished by:

a. increasing government spending such that aggregate expenditures are increased.

b. raising taxes and government spending by the same amount such that aggregate supply is decreased and aggregate demand is increased.

c. decreasing government spending such that aggregate demand is reduced.

d. lowering average tax rates such that aggregate supply is increased.

e. increasing transfer payments such that aggregate expenditures decline.

c

You might also like to view...

Explain what will happen when the government imposes a minimum price that is below the market equilibrium price. Why is this true?

What will be an ideal response?

What is one reason consumers might demand a discount for quantity purchases?

A) higher storage costs B) lower marginal cost C) lower marginal benefit D) price gouging

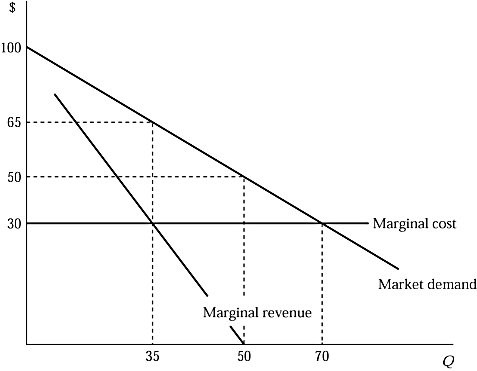

Suppose that Figure 7.5 shows a monopolist's demand curve, marginal revenue, and its cost. At the profit-maximizing output level and price, the consumer surplus would be:

Suppose that Figure 7.5 shows a monopolist's demand curve, marginal revenue, and its cost. At the profit-maximizing output level and price, the consumer surplus would be:

A. $2,450. B. $1,225. C. $612.50. D. $262.50.

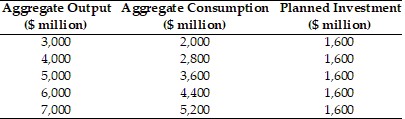

Refer to the information provided in Table 23.8 below to answer the question(s) that follow. Table 23.8 Refer to Table 23.8. At an aggregate output level of $4,000 million, the unplanned inventory change is

Refer to Table 23.8. At an aggregate output level of $4,000 million, the unplanned inventory change is

A. $1,200 million. B. $400 million. C. $0. D. -$400 million.