Suppose the Fed purchases $10 million of U.S. securities from the public. If the reserve requirement is 10 percent, the currency holdings of the public are unchanged, and banks have zero excess reserves both before and after the transaction, the total impact on the money supply will be a

a. $10 million decrease in the money supply.

b. $10 million increase in the money supply.

c. $100 million decrease in the money supply.

d. $100 million increase in the money supply.

D

You might also like to view...

Suppose that the income tax in the United States was such that all households had to pay 20 percent of their income to the government as taxes. This tax is an example of

A) a regressive tax. B) a proportional tax. C) a progressive tax. D) an efficient tax.

Those who favor changes in the market for health care that would make it more like the markets for other goods and services favor what are generally known as market-based reforms

Indicate whether the statement is true or false

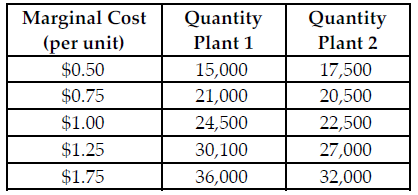

Refer to the table below. If Sweet Grams is a perfectly competitive firm and the market price $1.75 per unit, what is the profit-maximizing total quantity for Sweet Grams to produce?

Sweet Grams makes graham cracker snack packages. Sweet Grams is a multi-plant firm with two production facilities. The above table summarizes the total marginal cost of production at various output levels in the separate plants. Assume Sweet Grams is a perfectly competitive firm.

A) 68,000

B) 65,000

C) 75,000

D) 58,500

That each individual should engage in economic activities in which he or she is relatively more efficient is an application of the concept of

A) competition. B) absolute advantage. C) scarcity. D) comparative advantage.