An open market sale of U.S. Treasury securities by the Fed will cause the Banking System's balance sheet to show:

A. no net change in assets or liabilities, only a change in the composition of assets with securities increasing and reserves decreasing.

B. only an increase in liabilities.

C. no net change in assets or liabilities, only a change in the composition of assets with securities decreasing and reserves increasing.

D. only a decrease in assets.

Answer: A

You might also like to view...

The change in aggregate expenditures resulting from a movement in the domestic price level, which in turn changes the price of domestic goods in relation to foreign goods, is known as the:

a. international trade effect. b. multilateral equilibrium condition. c. international exchange rate effect. d. magnified international pricing effect. e. international deficit effect.

During the financial crisis of 2007-2009 the interest rate spread on mortgage-backed securities over Treasury bills

a. increased tremendously. b. increased moderately. c. decreased moderately. d. decreased tremendously.

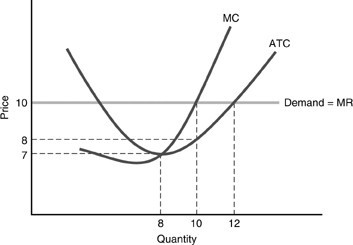

In the above figure, what is the price the firm receives if the output is 8?

In the above figure, what is the price the firm receives if the output is 8?

A. $10 B. $7 C. $2 D. $8

Refer to the information provided in Table 14.4 below to answer the question that follows. Table 14.4B's Strategy ?Raise PriceDon't Raise Price?RaiseA's profit $6,000A's profit $20,000?PriceB's profit $6,000B's profit $30,000A's Strategy????Don'tA's profit $30,000A's profit $10,000?RaiseB's profit $20,000B's profit $10,000Refer to Table 14.4. If both firms follow a maximin strategy, the equilibrium in the game is

A. (Raise Price, Raise Price). B. (Don't Raise Price, Raise Price). C. (Raise Price, Don't Raise Price). D. (Don't Raise Price, Don't Raise Price).