Legislators often have difficulty passing legislation with widespread benefits, but that imposes concentrated costs because those who bear the costs will __________ the legislation, while those who would reap the benefits will __________ the legislation

a. protest; actively support

b. not protest; not actively support

c. not protest; actively support

d. protest; not actively support

e. protest; protest

D

You might also like to view...

Ordinarily the Fed lends money only to banks, but during the Great Recession of 2007-2009 the Fed extended its lender-of-last-resort role to other financial institutions. These institutions included

A) securities dealers. B) investment banks. C) high-quality corporations. D) all of the above

Taxes paid divided by total income is the

A. Marginal tax rate. B. Nominal tax rate. C. Horizontal tax rate. D. Effective tax rate.

Which of the following best describes the adverse selection problem in health care?

A. The poor are exposed to medical disasters because they cannot afford to pay for insurance. B. Healthier people are less likely to buy health insurance because they are less likely to need it. C. The people who are selected for jobs with health insurance benefits are often the people who least need the health insurance. D. People don't know how much they will need to pay for health care in old age, adding to the risks of old age.

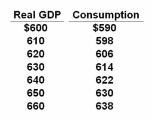

Refer to the above table. If planned investments were fixed at $16, taxes were zero, government purchases of goods and services were zero, and net exports were zero, then equilibrium real GDP would be $630 initially. If government purchases were then raised from $0 to $4, other things constant, then the equilibrium real GDP would become:

The table shows the consumption schedule for a hypothetical economy. All figures are in billions of dollars.

A. $660

B. $630

C. $640

D. $650