According to the Laffer curve, an increase in marginal tax rates

a. reduces total tax revenue.

b. increases total tax revenue

c. reduces total tax revenue when marginal tax rates rise past a certain point.

d. indicates that labor supply does not respond to changes in tax rates.

C

You might also like to view...

If a tariff is imposed on imports of shrimp into the United States, U.S. producers ________ and the U.S. economy will ________

A) gain; be unaffected B) gain; lose C) lose; lose D) gain; gain E) lose; gain

The official poverty rate for the United States is currently set at ____ times the cost of providing a nutritionally adequate diet

a. two b. three c. five d. eight

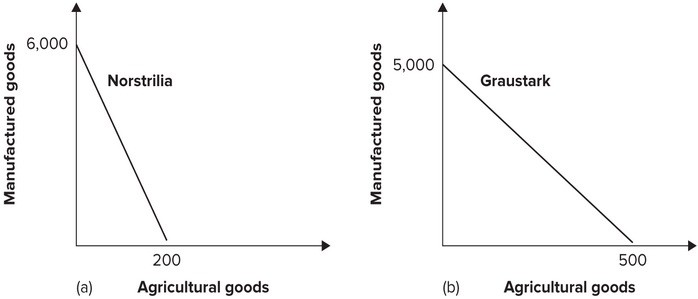

Refer to the graph shown. We can conclude from the diagram that:

We can conclude from the diagram that:

A. Norstrilia has a comparative advantage in both goods. B. Norstrilia has a comparative advantage in manufacturing and Graustark has a comparative advantage in agriculture. C. Norstrilia has a comparative advantage in agriculture and Graustark has a comparative advantage in manufacturing. D. Graustark has a comparative advantage in both goods.

If Bank A receives a new cash deposit of $150,000, and it has a required reserve ratio of 12 percent, how much money could potentially be created from that deposit?

a. $1,250,000 b. $18,000 c. $132,000 d. $150,000