Personal income tax withholding is

A. involuntary.

B. involuntary and designed to spread out the impact of taxes throughout the year.

C. designed to spread out the impact of taxes throughout the year.

D. voluntary.

Answer: B

You might also like to view...

When the price of a product is increased 15%, the quantity demanded decreases 10%. We can therefore conclude that the demand for this product is

A. cross-elastic. B. unitary elastic. C. inelastic. D. elastic.

If technological change is factor neutral, then the firm's isoquants:

A. shift out away from the origin. B. shift in toward the origin. C. do not change in appearance. D. become flatter.

A rightward shift in aggregate demand will cause an increase in the price level and no change in output if aggregate supply is

A. Downward-sloping to the right. B. Horizontal. C. Upward-sloping to the right. D. Vertical.

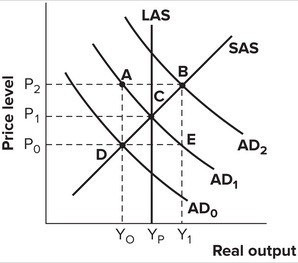

Refer to the graph shown. No changes in fiscal policy are advisable when the economy is at point:

A. A. B. B. C. C. D. D.